The Impact of AI on Investment Banking

July 26, 2023, In Management & Organizational Performance

Recently I have been discussing the impact of AI on the Investment Banking industry with successful leaders.

Whilst all agreed AI will help transform the industry and have a huge impact on the way we work, we also agreed the path is not clear yet!

So, what is the future for AI in Investment Banking?

As AI technologies continue to advance, Investment Banks can expect the following trends to develop

Future Investment Banking AI Trends

1) Advanced Natural Language Processing:

AI-driven natural language processing (NLP) will enable investment banks to extract valuable insights from unstructured data sources, such as news articles, research reports, and social media. This will enhance sentiment analysis, news-driven trading strategies, and customer intelligence.

2) Explainable AI and Interpretability:

Efforts are underway to enhance the interpretability of AI algorithms. Investment banks will strive to develop AI models that not only provide accurate predictions but also offer clear explanations for their decisions, facilitating better trust and adoption.

3) Robotic Process Automation (RPA):

RPA will play a significant role in automating routine operational tasks, allowing investment banks to achieve higher levels of efficiency and cost savings. RPA combined with AI capabilities will enable intelligent automation across a broader range of processes.

4) AI-Enabled Personalization:

Investment banks will leverage AI algorithms to deliver personalized financial services tailored to individual customer preferences, risk appetite, and financial goals. This will enhance customer experiences and deepen client relationships.

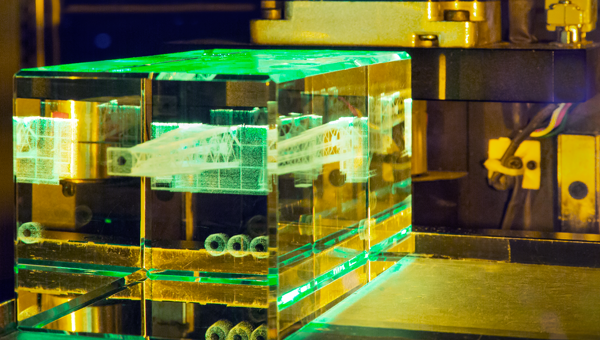

5) Quantum Computing:

The emergence of quantum computing holds immense potential for investment banking. Quantum algorithms can tackle complex optimization problems, risk modelling, and portfolio management with unprecedented speed, significantly impacting the industry’s capabilities.

6) Collaborative Intelligence:

Investment banks will harness the power of collaborative intelligence, where AI systems and human experts work together synergistically. The combination of human judgment, creativity, and contextual knowledge with AI’s analytical prowess will lead to more accurate and impactful decision-making.

So, will these trends provide opportunities only or challenges for an Investment Banker?

The answer is both! There are positives which will certainly enhance the role day to day.

Opportunities for an Investment Banker:

1) Access to Advanced Insights:

AI-powered tools can provide investment bankers with enhanced insights and analysis, enabling more informed decision-making and better investment strategies.

2) Increased Efficiency and Productivity:

Automation of routine tasks through AI can free up time for investment bankers to focus on higher-value activities, such as developing tailored investment solutions and building client relationships.

3) Personalized Customer Experiences:

AI-enabled personalization allows investment bankers to deliver customized financial services that meet individual client needs and preferences, strengthening client relationships and satisfaction.

4) Improved Risk Management:

AI algorithms can enhance risk assessment and monitoring, enabling investment bankers to proactively identify and mitigate potential risks, leading to more effective risk management.

5) Collaboration and Synergy:

Collaborative intelligence between AI systems and investment bankers can combine the analytical capabilities of AI with human judgment, resulting in more accurate and well-rounded decision-making processes.

It is important to acknowledge the challenges these trends create for an Investment Banker.

Challenges for an Investment Banker:

1) Ethical and Regulatory Implications:

The use of AI in investment banking raises ethical concerns around transparency, bias, and accountability. Investment bankers need to navigate these implications and ensure responsible and ethical use of AI.

2) Job Displacement and Adaptation:

As AI automation becomes more prevalent, some routine tasks may be replaced by AI systems. Investment bankers must adapt and acquire new skills to remain valuable in a changing work environment.

3) Cybersecurity Risks:

With increased reliance on AI and automation, investment banks must address cybersecurity risks and ensure robust measures are in place to protect sensitive financial data from potential breaches or attacks.

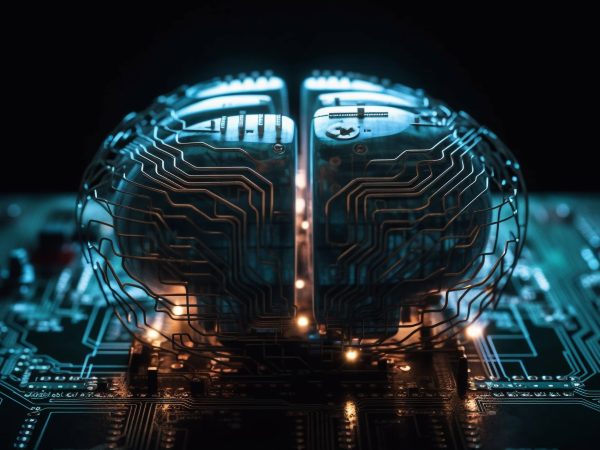

Embracing the AI-Driven Future of Investment Banking

The integration of AI technologies into investment banking has already seen transformative changes. From enhanced data analysis and decision-making to automation and risk management, AI is revolutionizing how investment banks operate and engage with clients.

As AI continues to evolve, investment banks must embrace the opportunities and challenges it presents. By adopting ethical practices, ensuring regulatory compliance, and fostering a human-AI partnership, investment banks can position themselves at the forefront of the AI-driven future, delivering innovative solutions and driving sustainable growth in the industry.